Do you want to have a lot of money, not just now but in the future when your fixed income disappears? Then you need to learn from the people who have already managed to obtain this goal. We’re talking about the rich, the one percent, the people who are on top of the world. If you want to be rich, you need to think about how people get to this point in life. There are multiple factors to consider here.

Most people who are rich don’t have one income, they have several. That doesn’t mean that they are working multiple jobs. Many of these incomes could be investments in things like the stock market or indeed property. If you understand how the property market works once you start investing you can easily make a lot of money. Of course, you need to understand what property to invest in, how to increase the value, who to sell to and what you need to do to attract interested buyers.

Or, some people get rich by starting their own company. There is one distinct advantage of being a sole trader or an entrepreneur. You get all the money you make, and you decide where to spend your revenue as well as the amount you take in profits. With this type of model, it’s easy to make a fortune in a few months rather than a few years. If your business is successful, that is.

You might think learning how to do this will be the end of your money problems. But anyone who is rich will tell you, that’s just the beginning. If you ever do make a fortune, you’ll find that making money was nothing compared to the challenge of holding on to it. You need to start the right spending habits. Otherwise you’ll quickly burn through most of your money.

So, let’s look at some of the lessons of the rich and see how their choices should impact your spending.

Don’t Buy Items That Depreciate Rapidly

We’re talking about tech that is going out of date in minutes or cars that will lose twenty-five percent of their value in the first year of ownership. Economic experts agree that it is never a smart idea to buy a car brand new, no matter how much money you make. It’s just not fiscally smart to do this because you’re essentially throwing money away. You’re never going to see the money you spend on that car again. By purchasing one second hand, you can cut what you’re going to lose down to size and still get the vehicle you want or need.

The same is true for technology. Why waste thousands on a computer that is going to be down to hundreds in a year or two. You should buy the tech second hand and opt for a slightly older model, saving a fortune.

We know what you’re thinking. Rich people always drive around in expensive sports car. You’d be surprised how many rent them when they want to be seen living a life of luxury rather than actually buying the vehicle. Don’t forget, people who are actually rich don’t tend to advertise the fact.

Pay Off Debts Fast

You should never willingly go into debt. You can borrow money without entering debt. Don’t forget, you’ll only be in debt if you don’t pay the money back on time. That’s why people who are rich always stay on top of any money that they owe and this is particularly true for credit cards. You should never let your credit card bills build up to the point where you are struggling to pay it off. There are 10 credit card tricks that will save you money and one is making sure that you’re paying the bills on time. Otherwise, you’re going to face high levels of interest, and you might even damage your credit rating.

It’s not just credit card bills of course. Any debts should be dealt with effectively. You might get a letter from the council claiming that you owe money. As long as the claim is legitimate, it’s best to pay it off rather than bother trying to fight it. By paying it off fast, you can keep yourself out of debt and ensure your credit score is not damaged at all.

Save More Than You Spend

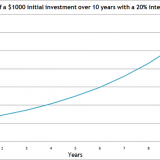

You might be surprised to learn that some people end up being rich in their later years because they know how to save. If you want to be wealthy in your twilight years the trick is making sure that you are saving the right way. You should aim to save as much as you can as often as you can. Ideally, you want to save more than you’re spending and you should work to invest as much as half of your monthly income. Now, for some people, this can be quite difficult. Particularly, if you are not in a high paying job. But, with a little work and a lot of determination you can cut costs in other areas of your life to ensure it’s a possibility.

Live Below Your Means

The best way to save more is to live below what you can actually afford. A perfect example would be the size of your house. It’s possible with your income, you can just about afford to live in a five bedroom home. But if you only have two children, do you really need that extra guest room? Or, if you’re children are still young, perhaps they can share a room? By doing this, you will be able to save more money and even spend in other areas. People might look at your lifestyle and think that you have a low paid job. In reality, you’re staying frugal and preparing for a future where you won’t have an income to live on.

There are lots of lessons you can learn from the rich when you’re sorting out your own finances. But some will involve making lifestyle changes that you might not yet be prepared for.